Securities laws are regulations designed to protect investors by ensuring transparency, fairness, and accountability in financial markets. These laws govern the offering, sale, and trading of investment instruments, such as stocks, bonds, and increasingly—crypto tokens

🔍 What Are Securities Laws?

Securities laws typically require:

- Disclosure: Companies must provide accurate, detailed information about investment offerings.

- Registration: Securities must be registered with relevant authorities (e.g., the SEC in the U.S.), unless an exemption applies.

- Anti-fraud rules: Misleading investors or manipulating the market is illegal.

Key regulatory bodies:

- United States: Securities and Exchange Commission (SEC)

- Europe: ESMA (European Securities and Markets Authority)

- Other jurisdictions: Each country has its own securities regulators and frameworks.

💡 How Do Securities Laws Affect Tokens?

- Not all tokens are considered securities—but some are. The legal classification depends on the token’s use case and structure.

✅ Utility Tokens

- Provide access to a product or service.

- Not usually securities if they have real utility and are not primarily sold as investments.

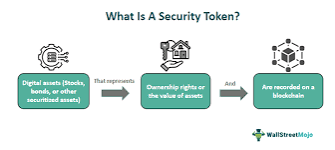

🚨 Security Tokens

- Represent ownership, revenue share, or expectation of profit.

- Likely to be classified as securities and must comply with securities laws.

- The U.S. SEC often uses the Howey Test to determine if a token is a security:

- > An investment of money in a common enterprise with an expectation of profits derived from the efforts of others.

If a token meets this test, it must:

- Be registered or qualify for an exemption.

- Be sold only to accredited investors (in many cases).

- Follow strict compliance rules (KYC, AML, investor disclosures, etc.).

⚠️ Consequences of Non-Compliance

- If a project launches or sells a token that is later classified as a security and they didn’t comply with securities laws:

- It can face fines, project shutdowns, lawsuits, or delisting from exchanges.

- Investors may have the right to rescission (get their money back).

🧭 What Projects Should Do

To avoid legal issues:

- Consult legal experts early in the token design process.

- Determine whether the token is a security, utility, or other type.

- Consider launching tokens in jurisdictions with clear crypto regulations.

- Use Reg D, Reg S, or Reg A+ exemptions in the U.S. if necessary.